Understanding the impact of credit scores is crucial for anyone looking to manage their finances effectively. A credit score is a numerical expression based on a level analysis of a person's credit files, representing the creditworthiness of an individual. It is primarily used by lenders to determine how risky a borrower you might be. Here’s how credit scores can affect various aspects of your financial life.

Borrowing Costs

The most immediate impact of your credit score is on your ability to borrow money. Lenders use credit scores to determine whether to lend you money and at what interest rate. A high credit score indicates that you have a history of managing your debt responsibly, which translates to lower interest rates on loans and credit cards. Conversely, a lower credit score can lead to higher interest rates, significantly increasing the cost of borrowing.

Mortgage Approvals and Terms

When it comes to buying a home, your credit score is often the key to unlocking favorable mortgage terms. A strong credit score can mean a lower interest rate, which can save you tens of thousands of dollars over the life of a mortgage. Additionally, a high score may also influence the amount of home loan you can qualify for. Poor credit scores might not completely bar you from getting a mortgage, but they can make the loans costlier and harder to obtain.

Renting Decisions

Landlords often check credit scores when deciding whether to rent to a potential tenant. A good credit score can make it easier to secure the rental you want and might even influence the security deposit amount required. A low score can signal to landlords that you might be a risky tenant, possibly leading to rejected rental applications or higher deposits.

Car Financing

Auto loans are another area where credit scores play a crucial role. Similar to mortgages, a higher credit score can help you secure better interest rates on auto loans. Dealerships also consider your credit score when offering lease agreements. Poor credit may not prevent you from getting a vehicle, but you could end up paying more due to higher interest rates.

Insurance Premiums

Many people don’t realize that their credit score can also affect their insurance premiums. Insurance companies use credit scores to create credit-based insurance scores which help them evaluate the risk of insuring an individual. A higher credit score can lead to lower premiums on auto and homeowners insurance, whereas a lower score can increase your rates.

Employment Opportunities

In some industries, particularly those that involve financial responsibility, employers might check your credit score as part of the job application process. A poor credit score can be seen as a lack of financial responsibility, which might hinder your chances of securing certain types of jobs, especially in the finance sector.

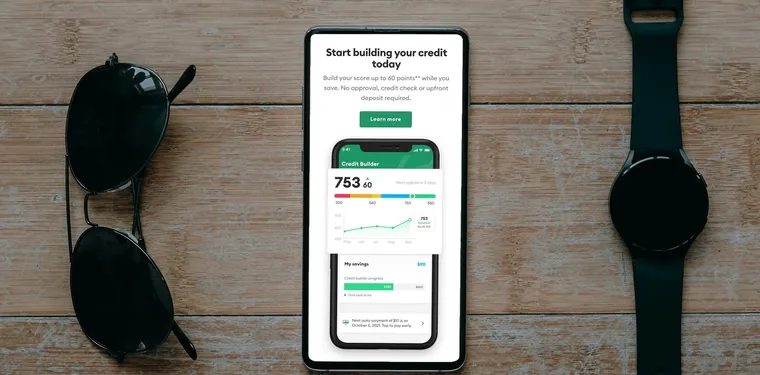

Building and Rebuilding Your Credit Score

Understanding how to build or rebuild your credit score is an essential financial skill. Regularly checking your credit report for inaccuracies, making payments on time, keeping your credit utilization low, and being judicious about opening new accounts are all strategies that can help improve your credit score.

Conclusion

Your credit score is a powerful number that shapes the financial landscape of your life. From securing loans and credit cards to renting apartments and paying for insurance, a good credit score can save you money and open up new opportunities. Conversely, a low score can cost you significantly. Therefore, managing your credit score wisely and understanding its implications is vital for financial wellness.